The vibrant US equity market offers investors a wide range of alternatives for investment. Among these, S&P 500 Sector ETFs have attracted significant traction for their ability to offer targeted exposure to distinct segments of the market. These ETFs, grouped by industry or sector, allow investors to customize their portfolios based on specific investment approaches.

- Consider for example, an investor aiming growth in the technology sector could allocate capital to a tech-heavy ETF tracking the S&P 500 technology index.

- Alternatively, an investor possessing a more risk-averse approach could explore exposure to sectors like utilities or consumer staples, which are often viewed as less volatile.

Evaluating the results of these ETFs is important for investors targeting to enhance returns and mitigate risk.

Decoding Sector ETF Returns: Identifying Trends and Opportunities

The dynamic nature of the financial markets makes it challenging to predict sector performance. Traders constantly evaluate sector ETF returns, seeking to identify trends and potential investment opportunities. By investigating the driving factors influencing sector performance, investors can improve their investment strategies.

Sector ETFs offer a focused way to access in the growth of particular industries. Understanding the variables impacting these sectors is crucial for profitable investment outcomes.

- Technological advancements can transform entire industries, creating both challenges and rewards.

- Macroeconomic trends such as interest rates, inflation, and consumer confidence have a substantial impact on sector performance.

- Regulatory changes can create volatility in the market landscape, influencing investment decisions.

By staying current on these dynamics, investors can align their portfolios to benefit on emerging opportunities.

Top Performing S&P 500 Sector ETFs for Your Portfolio

Diversifying your portfolio across different sectors within the S&P 500 can help mitigate risk and potentially enhance automated trading returns. Capital allocation in sector-specific exchange-traded funds (ETFs) provides a convenient way to achieve this diversification. Some of the topperforming S&P 500 sector ETFs for your portfolio include those focused on technology. Technology ETFs, such as the Vanguard Information Technology ETF (VGT), have historically exhibited robust returns. Healthcare ETFs, like the iShares U.S. Healthcare ETF (IYH), offer exposure to a sector with consistentgrowth. Finance ETFs, such as the Financial Select Sector SPDR Fund (XLF), can provide potentialgains tied to economic expansion. It's essential to conduct your own research and consider your individual risk tolerance before making any allocations.

Navigating the S&P 500: A Guide to Sector-Specific Investing

The S&P 500, a benchmark index of leading U.S. companies, offers investors a comprehensive range of investment opportunities. Despite it provides exposure to various sectors, allocation across distinct sectors can enhance portfolio return. This article illuminates the method of sector-specific investing within the S&P 500.

- Start by pinpointing your financial goals and tolerance.

- Research different sectors within the S&P 500 to understand their dynamics.

- Assess economic factors and sector outlook.

- Spread your investments across various sectors to manage risk.

- Monitor your portfolio returns and modify as needed to match with your objectives.

Unleashing Sector Potential: Strategies for S&P 500 ETF Investors

To thrive in today's dynamic market, investors seeking to harness sector growth must adopt sophisticated approaches. S&P 500 ETFs offer a flexible platform for exposure across key sectors, allowing investors to tailor their portfolios based on industry trends. A key consideration is performing thorough analysis to discover sectors exhibiting strong potential.

- Leveraging sector-specific ETFs can provide targeted investment to high-growth industries.

- Tracking key economic data points and regulatory developments can influence investment choices.

- Implementing a disciplined approach to portfolio optimization is crucial for controlling risk and enhancing returns.

By adopting these tactics, S&P 500 ETF investors can prepare themselves to harness the opportunities presented by sector growth.

The Power of Specialization: Investing in S&P 500 Sector ETFs

Unlocking performance potential within your portfolio involves proactive decision-making. One increasingly popular strategy is spreading investments across specific sectors of the S&P 500 index. Sector ETFs offer a targeted approach, allowing investors to benefit from the dynamics within particular industries. This strategy can boost overall portfolio risk management, as sectors tend to perform differently at varying points in the economic cycle.

- Consider ETFs that track sectors such as technology, healthcare, energy, or consumer discretionary to match your investments with your financial goals.

- Periodically assess your sector ETF allocations and make adjustments as needed to preserve your desired exposure.

- Bear in mind that past performance is not indicative of future results, and investing in sector ETFs involves inherent volatility.

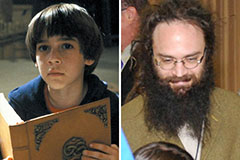

Barret Oliver Then & Now!

Barret Oliver Then & Now! Richard "Little Hercules" Sandrak Then & Now!

Richard "Little Hercules" Sandrak Then & Now! Danielle Fishel Then & Now!

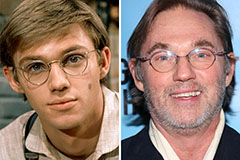

Danielle Fishel Then & Now! Richard Thomas Then & Now!

Richard Thomas Then & Now! Heather Locklear Then & Now!

Heather Locklear Then & Now!